Search, which serves as most people’s main access point to information, is at the forefront of the volatility. Here are the biggest takeaways from the article:

- Search habits are changing due to the recent pandemic

- A mix of COVID-19-related fear and need for education has propelled these shifts

- Paid search has been particularly susceptible to the volatility

- Industries such as healthcare, travel, online retail and CPG are seeing varying performance

- Brands can adapt by implementing both near-term and long-term solutions

- Near-term: keyword selection, bidding and dayparting

- Long-term: content development and relevancy-based adjustments

Paid Search and the Current Climate

Paid search is a unique channel. It’s incredibly reactionary, often policing itself when consumer sentiment experiences sudden shifts. When the coronavirus-induced stock market volatility initially began, most search campaigns saw a drop-off in volume due to a) people searching for other, more important topics and b) fear-related hesitation. Consumers were unsure what the future would hold due to COVID-19, therefore they stopped entertaining the idea of certain purchases.

That threshold is different for each consumer, but it’s often tied to income. Those with more disposable income, savings and investments are better prepared to weather the storm. Those with less – living day to day, paycheck to paycheck – might not be as ready to take on such headwinds, understandably.

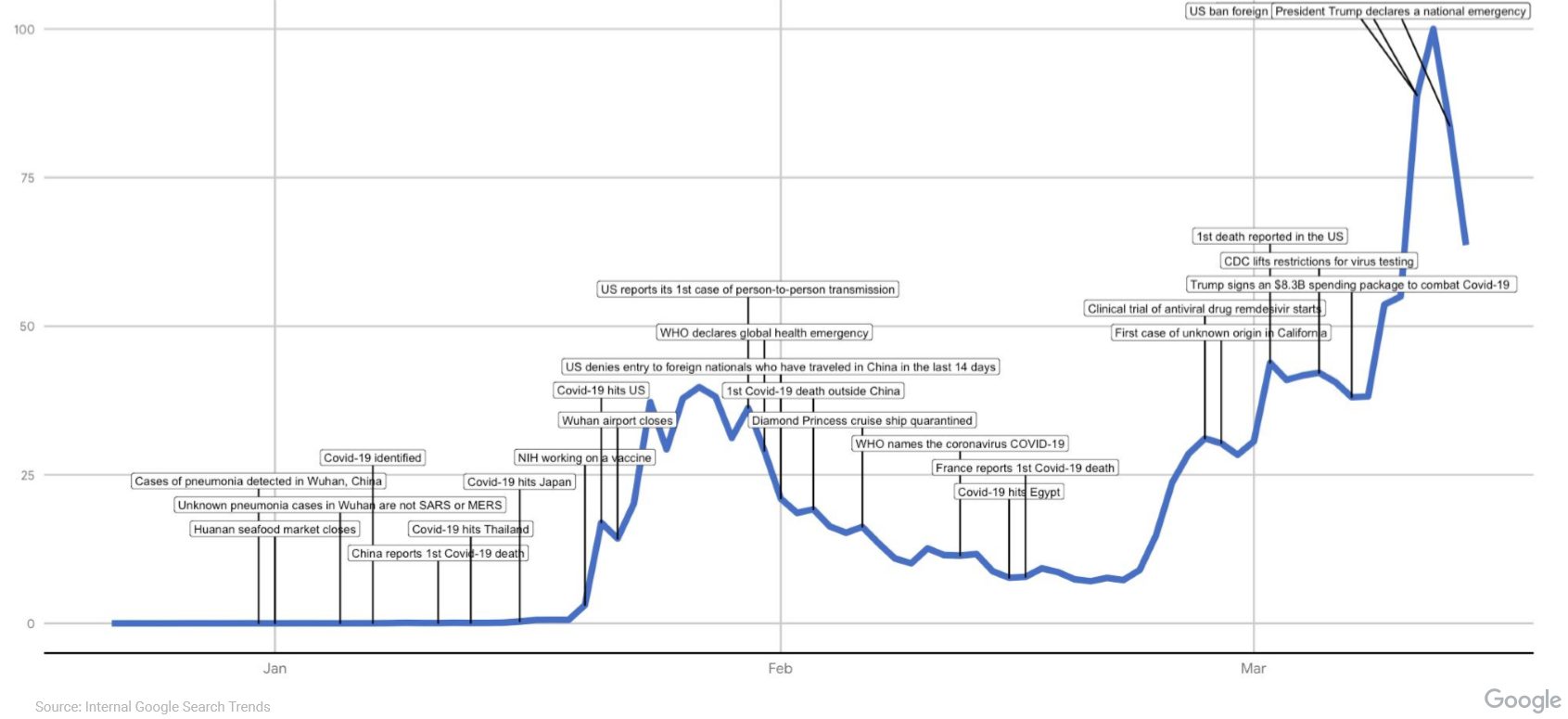

As more and more news emerged, more and more time was spent on coronavirus-based searches. Data from Google shows consumer interest ebbed and flowed with the arrival of additional news around COVID-19.

According to Google, coronavirus-related searches have grown 320% since January. Consumers want to know more about prevention, preparedness and fending off the boredom associated with being housebound for an extended period. It’s also seeped into the core of our mental well-being. As Google notes, “It’s often the last thing on people’s mind when they go to bed and the first thing on their mind when they wake up.” This is backed by search spikes around the pandemic corresponding daily with the typical wake/sleep timing for most U.S residents.

How Search has Changed

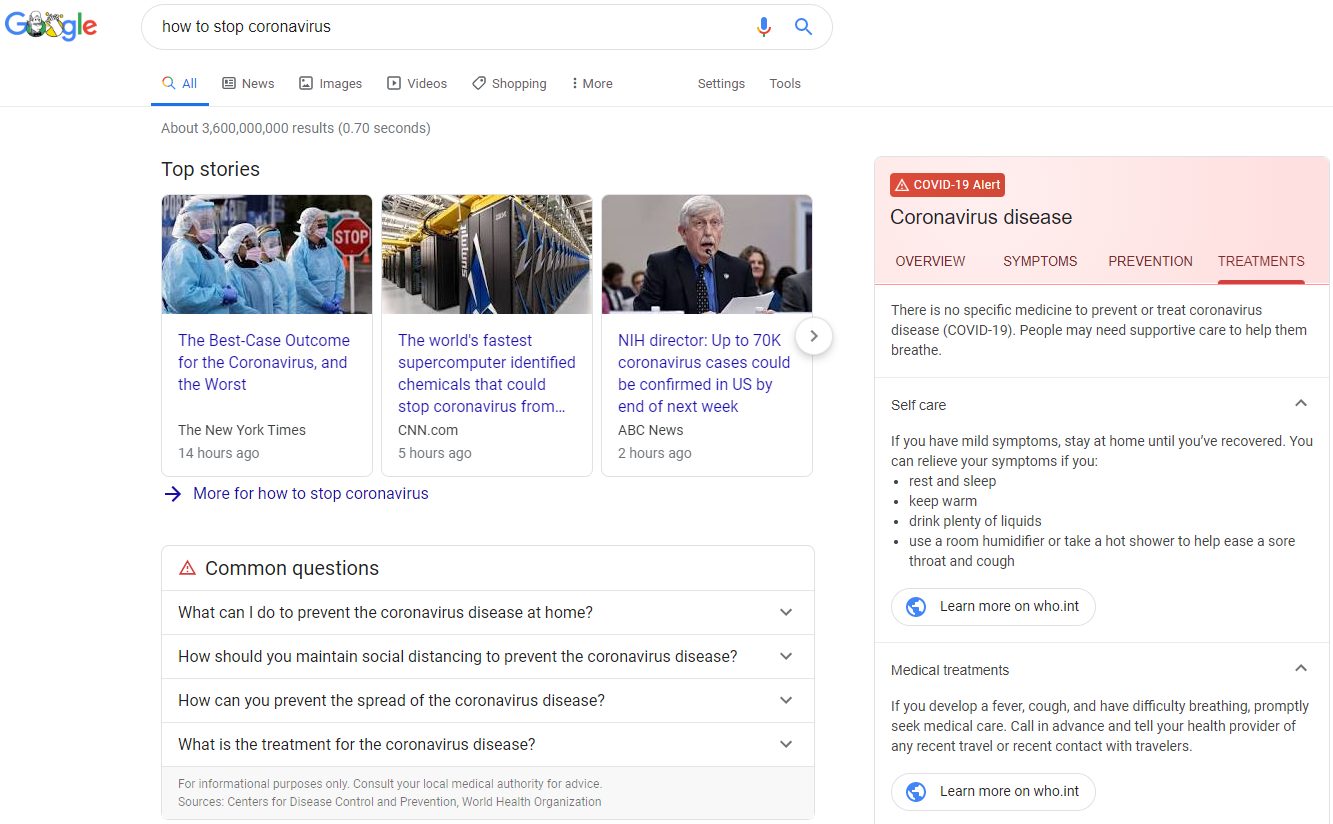

Search – at its very core – is education-based. Google is the quickest path to an answer. They’ve prided themselves over the last few years on shifting from providing millions of results to providing a single answer. Google’s Knowledge Graph and Featured Snippets are prime examples. At a time like this – when everyone is searching for answers to the same questions – overall search habits will inevitably change.

This mixture of shifting search trends combined with the uncertainty and fear associated with economic turmoil has led to some swift changes within the paid search landscape. It obviously varies (boom/bust) based on industry, but regardless of the product or service, one theme persists: volatility. Empower has seen clients relying on locations – healthcare, location-based retail, travel/tourism, etc. – hit hardest. Search volume for these clients – and more recently, conversion rates – have followed the ups and downs of the markets in near real-time.

On the other side, there are multiple sectors seeing spikes in the positive direction. CPG (household cleaning and canned goods specifically), online retail and STEM/education-based clients have seen growth. Products that can combat the virus or combat circumstantial effects associated with the virus – whether it be boredom, the need to entertain and educate homebound schoolchildren, etc. – have become the focal point of consumer spending and interest.

The Tipping Point for Paid Search

The week of March 16th was the most telling thus far for paid search. It began with heavy stock market turmoil. It ended with shelter-in mandates across New York, California, Illinois and Connecticut. As the situations worsened, paid search conversion rates for these sectors swiftly followed the downward trend. They started rough on Monday, then fell off more aggressively as the week progressed. Hardest hit were the previously noted bust industries. The shelter-in mandates drove an unavoidable, yet non-life-threatening consequence. They hand-cuffed any hope of a swift return to normalcy for most foot traffic dependent industries.

How Paid Search Can Adapt

For most brands, the upcoming weeks may be very lean times when ad budgets are pushed off (or cut altogether) due to the combination of a lack of volume and lower conversion rates. This may sound dire, but it can also be viewed as a time to refocus paid search efforts.

Table Stakes

Keyword Selection – Eying performance is first and foremost. Those hardest hit by this need to ensure active paid search keywords have been whittled down to drive efficiency via near-term initiatives.

Algorithmic Bidding – Algorithmic bidding within paid search can be an incredibly impactful tool, especially when predictive bidding based on historical performance can be trusted. But as of late, the volatility within search has been too extreme to expect an algorithm to make decisions at a keyword level. When daily keyword performance doesn’t align at all with past results, an algorithm dependent on interpreting keyword performance can’t be trusted.

As a fail-safe, paid search algorithms often have excluded dates that can be applied. This tactic eliminates data from specific timeframes when gauging keyword-based bidding decisions. In any other period, one could simply exclude the last few weeks, and go on from there. But forward-looking volatility still exists within search, so this tactic can’t be depended on.

Within paid search, a manual approach is the best route in the near term. Once performance rebounds and search habits return to normal, the dates most affected can be excluded and algorithmic bidding can be held accountable.

Dayparting – Limiting or expanding bids to take advantage of only the most profitable dayparts is a strategy deployed throughout the year via manual or script-based adjustments. Over the next few weeks, brands need to be even more extreme with their dayparts. Going dark during certain times in the day is not a bad thing – especially when the performance doesn’t dictate being live.

Negatives – Negatives can ensure your brand isn’t pulled into any ballooning, hysteria-bases searches. Negatives specific to coronavirus/COVID-19 and any news-related searches that have seen upticks recently should be implemented immediately (if not already).

Bigger Picture

Messaging – Helpfulness is the main goal. Brands need to demonstrate they’re here to help, not capitalize. Every single character within a paid text ad should be devoted to helpfulness and encouragement.

Relevancy/Quality Score – This timeframe may present the opportunity to slow things down and focus efforts on relevancy and quality score. If the idea of improving relevancy has been held back by a full-steam-ahead directive towards conversions (and those two approaches potentially being at odds) this may be a chance to re-tool and start fresh. Brands can come out of this ordeal with a renewed perspective and approach, designed to merge relevancy, efficiency and profitability via alignment across on-site content, text-based ad copy and keyword builds.

Content/Organic – A renewed reliance on organic content development should emerge from the pandemic. The idea that informing and educating consumers is still an incredibly vital part of the overall interaction. Brands should be rushing to create pieces that engage with consumers, especially brands that might not have many near-term sales in their future. Advertisers need to consider their long-term relationships with consumers. Being viewed as a thought leader could help strengthen a more enduring, long-term interaction that reignites as consumer sentiment rekindles.

Overall, advertisers and consumers both need to realize the pandemic will subside. It may seem never-ending now – while everyone is wading knee deep in it – but it can’t last forever. It will have indelible effects on the media landscape moving forward, though. Most of these changes will be for the better. Ones that will strengthen the bonds between consumers and the brands designed to serve them.