In the previous installment, we reviewed the auction and ranking dynamics of both platforms. Within this article, we’ll focus on how attribution is accounted for across each.

Attribution

Once a seller makes a sale, how that sale went down (and when credit is given) is tallied differently across these two retailers. Very differently.

Amazon

Their attribution is rather straight-forward. They offer a 14-day click-based window. This window applies across the brand. For example, if someone clicks on a sponsored ad, then purchases any product from that brand within 14 days, that click is credited with the conversion.

A good percentage of the revenue across this 14-day window can be attributed to non-direct click-based conversions i.e. someone clicking on an ad, then coincidentally purchasing another product from the brand’s catalog later.

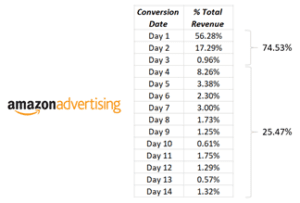

Looking at Amazon sponsored search revenue data from a subset of our client’s data, we found that even the specific days within the 14-day window demonstrated a greater disparity in revenue distribution than anticipated. Below is a look at the percentage of total revenue driven during each day of the 14-day window:

Roughly 25% of the revenue derived from the 14-day window comes in after that initial 3-day window. This will be important to remember as we move into discussing how Walmart’s standard metrics interpret this same data.

Walmart

Walmart’s application of attribution metrics, along with their lookback windows, are a bit more of a corkscrew. They offer advertisers multiple choose your own adventure-esque routes to tallying revenue. The below details their attribution metric naming conventions, along with associated conversion windows:

- Direct Click Revenue (3 day) – Attributed revenue via direct click of an advertised item

- Direct View Revenue (1 day) – Attributed revenue via view of an advertised item

- Brand Click Revenue (3 day) – Attributed revenue via direct click of the same brand as the advertised item

- Brand View Revenue (1 day) – Attributed revenue via view of the same brand as the advertised item

- Related Click Revenue (3 day) – Attributed revenue via direct click of same brand & category as advertised item

Walmart’s default reporting metrics include a combination of (1) Direct Click Revenue and (2) Direct View Revenue for sponsored search. Including view-through metrics is odd enough for a search buy, and many have called out this approach as a guarantee of over-reporting, seeing as other retailers (Amazon) are solely click-based, but there are a few nuances that make their overall approach—and the inclusion of view-through—more palatable:

- Walmart’s click-based attribution window is a mere 3 days, whereas Amazon’s runs 14 days

- As noted, Amazon would only see about 75% of the revenue it traditionally sees if its conversion window was pulled back to the three-day mark

- Walmart only uses a 1-day view-through window within sponsored search

- Incorporating view-throughs in search isn’t a normal approach, but …

- Both Walmart and Amazon’s ads are shopping ads, which include text and imagery

- The inclusion of imagery, despite being classified as search ads, should open these ads up to a similar “view-based” approach as seen across more display-focused tactics

One caveat would be related to carousel ads within Walmart’s interface. These exist as sponsored ads at the bottom of the page, and viewability can certainly be an issue (seeing as Walmart doesn’t adhere to IAB standards). It’s something to keep in mind regarding the validity of 1-day view inclusion (i.e. over-reporting due to views that aren’t really views).

Next, we’ll be reviewing the offline revenue approaches of both Amazon and Walmart. Not to give away any trade secrets, but neither retailer accounts for offline revenue generated via sponsored search. Despite this, there are assumptions that need to be made as it relates to potential offline gains.