The ecommerce giant saw a 71% uptick in sales ($7.16 Billion) compared to year prior and, over the course of two days, the event totaled more unit sales for Amazon than both Black Friday and Cyber Monday combined. By putting their immense stockpiles of customer data to use in paid media offerings, retailers like Amazon have found another revenue stream beyond their hauls from product sales. Search ads are a prime example, which advertisers can buy through Amazon Advertising Console. These ads allow advertisers to place unique, tailored ads in front of Amazon.com users based on recent search and purchase behavior. They also offer the potential for these same advertisers to interact with consumers the second before purchase – either to fortify their brand or possibly swoop in and conquest a competitive sale.

Seeing all that’s at stake, if brands want their share of the ecommerce landscape, they need to play well with Amazon and other retailers. Nowhere is this truer than the paid search landscape these online retailers have devised.

Paid Search at the Retail Level

Amazon, Target and Walmart all have paid media platforms – selling ad space along the organic listings and Product Detail Pages (PDPs) of their own properties and properties across the web. It’s an approach taken right out of Google and Facebook’s playbooks, then ratcheted up a few notches due to the proximity of competitive brands and the point-of-no-return/bottom of the funnel status of their site visitors.

Take baby products on Amazon for example; among organic listings for the keyword “diapers” are paid ads. These appear in the following formats:

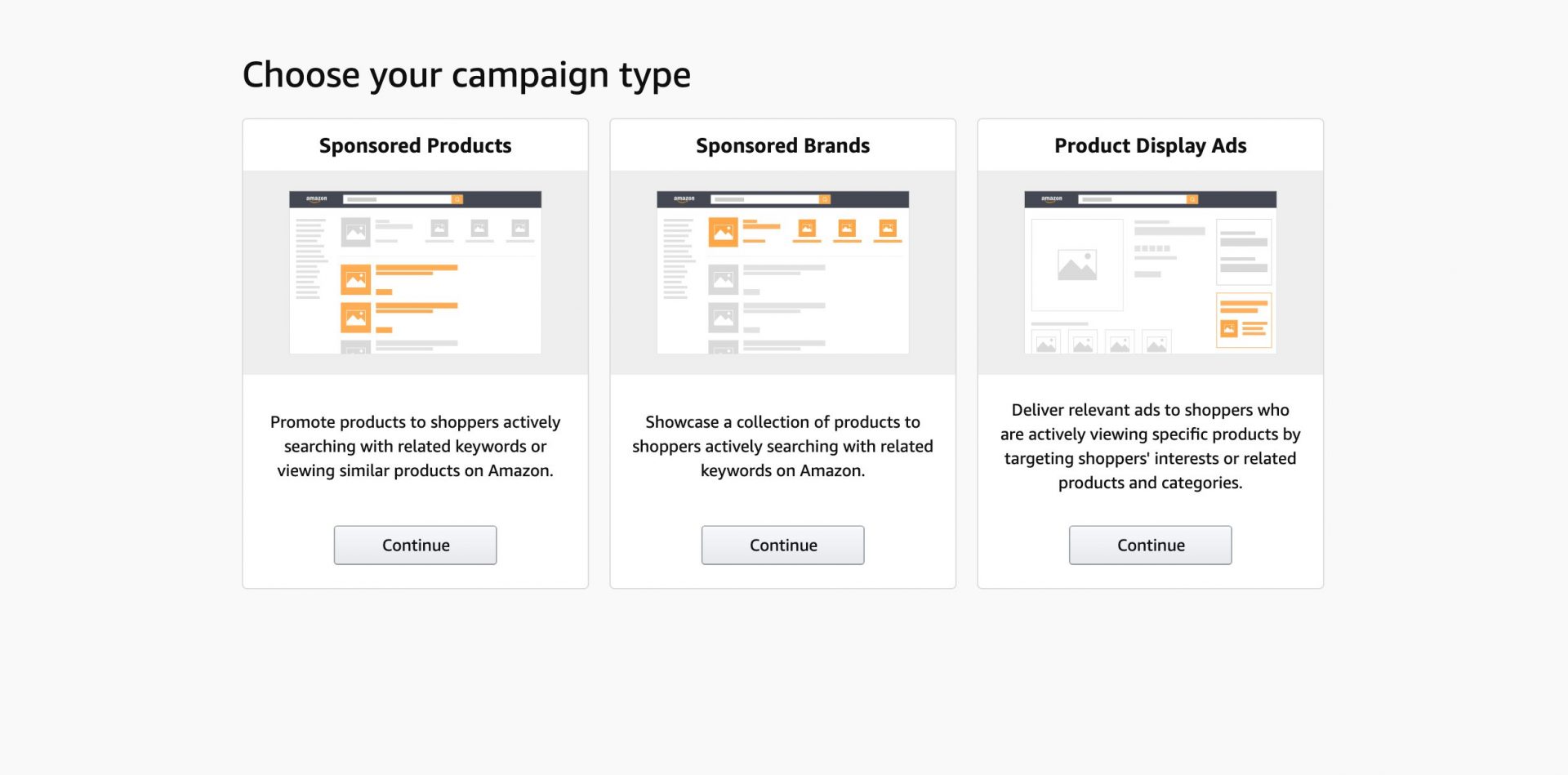

- Sponsored Products Ads (SPAs)

- Product-specific placements appearing throughout the search results and PDPs

- Sponsored Brand Ads (SBAs)

- High visibility placements that show above, to the left of and below the search results

- Product Listing Ads (PLAs)

- Display ad placements appearing on the product detail, thank you and review pages

As it relates to paid ads, whichever brand represents the best combination of bid + consumer affinity/preference will likely win the auction and have their ad served. Very much the definition of a second price auction, where every brand is vying for a generic term (diapers) that no one truly owns. The winner of the auction will possess the right mix of bid and relevance in relation to the individual consumer.

Defending Your Brand

Using the previous “diapers” example, a person may search for the brand phrase “Pampers Size 4.” As expected, the organic results shown within Amazon will be very focused on Pampers products. But above those organic listings could be a Sponsored Brand Ad (SBA) for Huggies. And intermixed within those organic Pampers listings could be Sponsored Product Ads (SPAs) for Luvs or Honest Company. These paid competitive entrants cloud the landscape and put a potential sure-fire conversion for Pampers in serious jeopardy.

Nowadays, getting a consumer to your products on an online retailer’s site isn’t enough. The paid landscapes the Amazons, Targets and Walmarts of the world have created contain an added layer – at the last moment in the funnel –any brand’s biggest competitor could easily infiltrate if they’re willing to pay enough to steal share.

The Good and the Bad

On one hand, the ad environments Amazon and other retailers have created represent an opportunity for brands to fortify their message the moment before purchase. To ensure consumers get that one final push they need to officially convert. Solidifying brand loyalty in the process.

On the other hand, these ads represent a scare tactic in its purest form. Forcing advertisers to purchase ad space on their own product pages. Because if they don’t, someone else will. It’s not just the lost sale that will haunt, it’s also the wasted energy expelled to push that user down the entire funnel, only to lose them at the very last moment.

There are safeguards built into similar platforms that keep such things from happening. Google Ads, for example, has quality score. Amazon and other retail channels don’t have safeguards like this. Amazon uses its understanding of the consumer to serve the best possible ad. The assumption being if someone is searching for Pampers, they’ll likely be served an ad for Pampers, since it aligns with their interests.

In doing this, they’ve left the door open for the cutthroat competitive mentality that permeates most of their ad placements.

Can Non-Amazon Retailers Gain Traction?

Both Target and Walmart have made ecommerce a huge priority. Target went the rebranding route – creating their own media arm and renaming it Roundel. Walmart lured execs from media giants such as CBS and NBC Universal to help buoy their advertising business. But, Amazon is still Amazon. It’s the largest player with the largest product catalog and the largest consumer mindshare. Target and Walmart may chip away, but Amazon will still be king commerce.

As of right now, there’s a wide gap of who’s using what. In a recent study by Digiday wherein they surveyed media buying execs:

- 90% bought media via Amazon this year

- 23% bought media via Walmart this year

- 16% bought media via Target this year

Future investment in these platforms suggests Amazon will maintain its stronghold. 80% of respondents planned to increase spend in Amazon this year, while only 20% and 14% planned to increase investment in Walmart and Target, respectively.

Another strike against non-Amazon players is their managed service approach. Target insists all search media driven through Target.com be run by their in-house team, which is unconventional to say the least. This causes conflict since – more often than not – manufacturers paying for these services already have their own paid search campaigns supporting their products. Having two separate entities running search ads for the same products can be a recipe for disaster if strategic cooperation doesn’t exist. And, when one of those entities is as large as Target (Roundel), that isn’t always possible.

Amazon, on the other hand, offers a self-service advertising platform. They also recently launched their own pixel-based attribution offering that can track consumers from media click (via Google Ads, Facebook Business Manager, etc.) all the way to purchase on Amazon.com and going a long way towards removing the closed-off data approach that has historically permeated most paid media platforms.

Where Advertisers Should Invest

Despite Amazon’s overwhelming edge in both market share and resources, there are always going to be consumers that are Target loyalists or Walmart fans. A well-rounded approach will hit as many consumers as possible. To accomplish this, advertisers need to understand people have options. One out of every three U.S. consumers are Amazon Prime Members – a staggering number. That leaves 2/3 of the nation up for grabs.

If brands, however, don’t invest in Roundel or Walmart Media Group, they’ll likely be alienated by those retailers and eventually see reduced support from them. In order to reach as many consumers as possible (and to keep all partners happy), dollars need to be distributed across all platforms. The key word being distributed. They don’t necessarily need to be distributed evenly, they just need to be distributed.

There are a lot of mouths to feed in the ecommerce landscape. Keeping all those mouths fed might just be the biggest challenge of all.